In 2000, Google famously incorporated a simple catchphrase into its corporate code of conduct: “Don’t be evil.”

The idea, said Google, was that “everything we do in connection with our work at Google will be, and should be, measured against the highest possible standards of ethical business conduct.”

Google’s founders recognized that the growth of its search and ad platforms was turning the company into a powerful entity with the ability to shape user’s understanding of the world. While the “don’t be evil” catchphrase was mocked by some, it did at least imply that the company saw that its growing power came with certain responsibilities. The tech industry could use more of this sentiment in 2020.

Chaos in the streets is a feature, not a bug

Fast forward 20 years, 3.5 years after Facebook helped elect Donald Trump to the presidency, and America is in crisis.

The country is now run by a president who, as Jim Mattis, Trump’s first Secretary of Defense, put it, “is the first president in my lifetime who does not try to unite the American people—does not even pretend to try. Instead, he tries to divide us.” There are parallels in this to how Trump ran his 2016 campaign, deftly using Facebook and other social media to micro-target his messaging.

Since George Floyd was killed by a Minneapolis police officer on May 25, and the video of the killing went viral, protests have spread nationwide, to even the smallest of towns. Some opportunists have used the protests for looting, as is always the case, and some far-right, pro-Trump actors have deliberately engaged in looting and vandalism in order to give cover to any resulting police crackdowns. The bulk of the violence, though, is top-down. Egged on by Trump, police officers and an array of other armed security officers have reacted to largely peaceful assemblies of their fellow Americans with violent tactics and gear designed for fighting wars.

Patrick Skinner, a writer, former intelligence officer, and now police officer in Georgia, implied this violence was by design on his Twitter feed recently:

“Don’t let us off the hook by saying this orgy of violence is a failure in training. It is not. It is the result of training for war. Don’t say it’s a lack of a few de-escalation power points. It is not. It is the result of training for war. Our entire mindset is a war on crime.”

Racism didn’t start with Trump, nor did the militarization of the police. But this President has used a unified right-wing mass media propaganda machine and the tech industry’s social media tools to make both hip again. Cultivating a tough-guy image, he once urged a police group, “Please don’t be too nice” to suspects. Note his focus: “Suspects,” as opposed to convicted criminals.

Today, hundreds of thousands (if not millions) are protesting to be heard, at great personal risk, while the COVID-19 pandemic rages on. Republican politicians are under pressure to preserve an image of a good economy, in hopes of a Trump re-election, so public health concerns take a back seat. The political movement that claimed to be concerned with the lives of the unborn, and responds to “Black Lives Matter” chants with the inane “All Lives Matter,” is now persuading the public to overlook the 100,000+ deaths from COVID-19 and just get back to work.

In my home state of Arizona, which has a population of over 7 million, more than 1,000 people have died from COVID-19. Prior to this, I lived in Thailand for a decade. That country, which has more than 70 million — more than 10 times than that of Arizona — has recorded fewer than 100 COVID-19 deaths. And Arizona’s gross domestic product per capita (nominal) is over five times that of Thailand. What good is wealth if elected leaders don’t use it to invest in things like public health for their constituents?

As Mattis said in his recent statement, “We are witnessing the consequences of three years without mature leadership.”

Tech executives continue to hedge their bets

We are also witnessing how obsessed with money the rich and powerful of this country have become.

The hundreds of Internet companies to make it big since Google’s advent have become even bigger since Trump’s 2017 tax reform directed massive tax cuts to corporations and high-income individuals. Their top execs have become far wealthier. Even with extreme levels of unemployment and a steep GDP drop inevitable in 2020, these folks are doing just fine.

Surely, you would think, the largely liberal (so we’re told) tech sector would have spoken out by now, publicly critiquing not only specific acts of police violence but, more importantly, the messaging sent from the top. Yet, when we surveyed the top few execs of the largest companies in the U.S. Internet and telecom sectors, we came up largely dry. If wealth is supposed to free you to do and say what you want, the results have been revealing (Table 1).

Table 1: Public comments on George Floyd and Racism by Tech Execs

| Company |

Market cap (U.S. $B) |

Tech executive |

Public comments |

| Alphabet |

977.0 |

Sundar Pichai, CEO |

Posted a picture of a modified Google search home page, with new text: “We stand in support of racial equality, and all those who search for it.” Pichai’s post: “Today on US @Google and @YouTube homepages we share our support for racial equality in solidarity with the Black community and in memory of George Floyd, Breonna Taylor, Ahmaud Arbery & others who don’t have a voice. For those feeling grief, anger, sadness and fear, you are not alone.” |

| Amazon |

1,220.0 |

Jeffrey Wilke, CEO, Consumer |

Two tweet thread: (1) “A friend who is a Black man sent me an email today that included: “The narrative that security of accomplishment will somehow lead to equality in this country for people of color, especially Black men, is a false narrative. It is simply not real.” (2) “Since I’ve subscribed to this idea — that facilitating achievement was the key to solving the problem — I looked in the mirror and asked “Have I done enough? Have I listened carefully enough?” Clearly the answer to both is “no.”” |

| Amazon |

1,220.0 |

Andrew Jassy, CEO, Amazon Web Services |

Tweeted “*What* will it take for us to refuse to accept these unjust killings of black people? How many people must die, how many generations must endure, how much eyewitness video is required? What else do we need? We need better than what we’re getting from courts and political leaders.” |

| Amazon |

1,220.0 |

Jeff Bezos, COB & CEO |

Posted an essay on Instagram called “Maintaining Professionalism in the Age of Black Death is…A Lot”. Bezos’ personal intro to the essay: “The pain and emotional trauma caused by the racism and violence we are witnessing toward the black community has a long reach. I recommend you take a moment to read this powerful essay from @goldinggirl617, especially if you’re a manager or leader.” |

| Apple |

1,380.0 |

Tim Cook, CEO, Director |

Tweeted “Minneapolis is grieving for a reason. To paraphrase Dr. King, the negative peace which is the absence of tension is no substitute for the positive peace which is the presence of justice. Justice is how we heal.” |

| Disney |

211.9 |

Robert Iger, Executive COB |

Tweeted “Below is a link to a statement we sent to our fellow @Disney employees. It’s from Bob Chapek, our CEO, Latondra Newton, our Chief Diversity Officer, and me. Thank you.” The link is a letter to Disney employees that discusses George Floyd. |

| Microsoft |

1,390.0 |

Satya Nadella, CEO, Director |

Re-tweeted a Microsoft Corp. post that it would be using its platform to “amplify voices from the Black and African American community at Microsoft.”. Nadella’s post says, “There is no place for hate and racism in our society. Empathy and shared understanding are a start, but we must do more. I stand with the Black and African American community and we are committed to building on this work in our company and in our communities.” |

| Netflix |

184.6 |

Reed Hastings, COB, President, CEO |

Retweeted a video promoting non-violence, which said: “Some protestors in Brooklyn calling to loot the Target, but organizers are rushing in front of the store to stop them, keep things non-violent #nycprotest” |

| Snap |

27.4 |

Evan Spiegel, CEO, Co-Founder, Director |

Posted a Snapchat with intro saying, “We condemn racism. We must embrace profound change. It starts with advocating for creating more opportunity, and for living the American values of freedom, equality and justice for all. Our CEO Evan’s memo to our team:”, followed by a link to a message written by Evan to his team members. |

| Twitter |

24.3 |

Jack Dorsey, CEO, Director |

Active participant in online discussion, largely through re-tweets, several of which highlight police violence. In May, raised Trump’s ire by flagging one of his tweets for “glorifying violence.” An important but small step, though: the New York Times reviewed a set of Trump tweets for the week of May 24th, and found at least 26 out of 139 posts contained clearly false claims. |

| Verizon |

237.4 |

Hans Vestberg, COB, CEO |

Pinned a Tweet and posted the video on Instagram as well as from Verizon’s Twitter feed of a video clip of himself speaking up on the death of Floyd, captioned “We cannot commit to the brand purpose of moving the world forward unless we are committed to helping ensure we move it forward for everyone. We stand united as one Verizon.” |

| Verizon |

237.4 |

Ronan Dunne, EVP, CEO Consumer Group |

Tweeted, “While it’s hard to find the right words, we need to do more than speak — we need to listen and act. I’ll do my part to learn and help elevate the voices that will drive the change we want and need to see in the world. #ForwardTogether”, followed by a link to a video of CEO Hans Vestberg speaking on the subject. |

Note: all posts are from the May 30-June 3 timeframe; exact dates available in links.

Most prominent execs have simply kept their heads down. One big exception is Jack Dorsey of Twitter, who appears to have had a recent awakening as to the power of his company’s platform and how well it has been manipulated by the powers that be. Watch Jack.

Snap CEO Evan Spiegel has also started to find a voice, first deciding to stop promoting (for free) content from Trump on Snap, and saying that Snap needs to “embrace profound change.”

Many more execs have issued bland, low-risk statements, sometimes head-scratchingly vague, as with the Verizon CEO’s focus on “the brand purpose of moving the world forward.” Apple CEO Tim Cook quoted the Rev. Dr. Martin Luther King Jr. on Twitter, saying “positive peace” requires the “presence of justice.” Cook also sent a letter to employees which received some public praise.

Yet the Cook letter also risked almost nothing, for Apple as a company and Cook personally. Silicon Valley VC Vinod Khosla pointed this out in response, saying that “it’s easy to support equality & justice…it’s when one has to give up something to support it that belief in our real values show up. @tim_cook easy to talk but why do you suck up to @realDonaldTrump?”

Exactly the point.

Let’s not forget, we are talking about some of the wealthiest, most powerful people in America. The few who have spoken recently are clearly in favor of equality, and pro-human rights, but their statements read as largely vacuous lip service. Recall that clause within the U.S. Declaration of Independence, “All men are created equal.” Inspirational, yes, but, at the time, white male property owners just happened to be a little more “equal” than others.

Words are easy to toss around, then and now. Actions count.

If you have ever read the Bible, whether as a believer or a student of philosophy, this quote seems apt: “To whom much is given, much will be required.”

What can tech do?

The first step to fixing a problem is accepting that you have one. Some tech companies have arrived at this point, notably Twitter.

The second step, in this case, is deciding that you have the resources to fix the problem. On that note, some market data may come in handy.

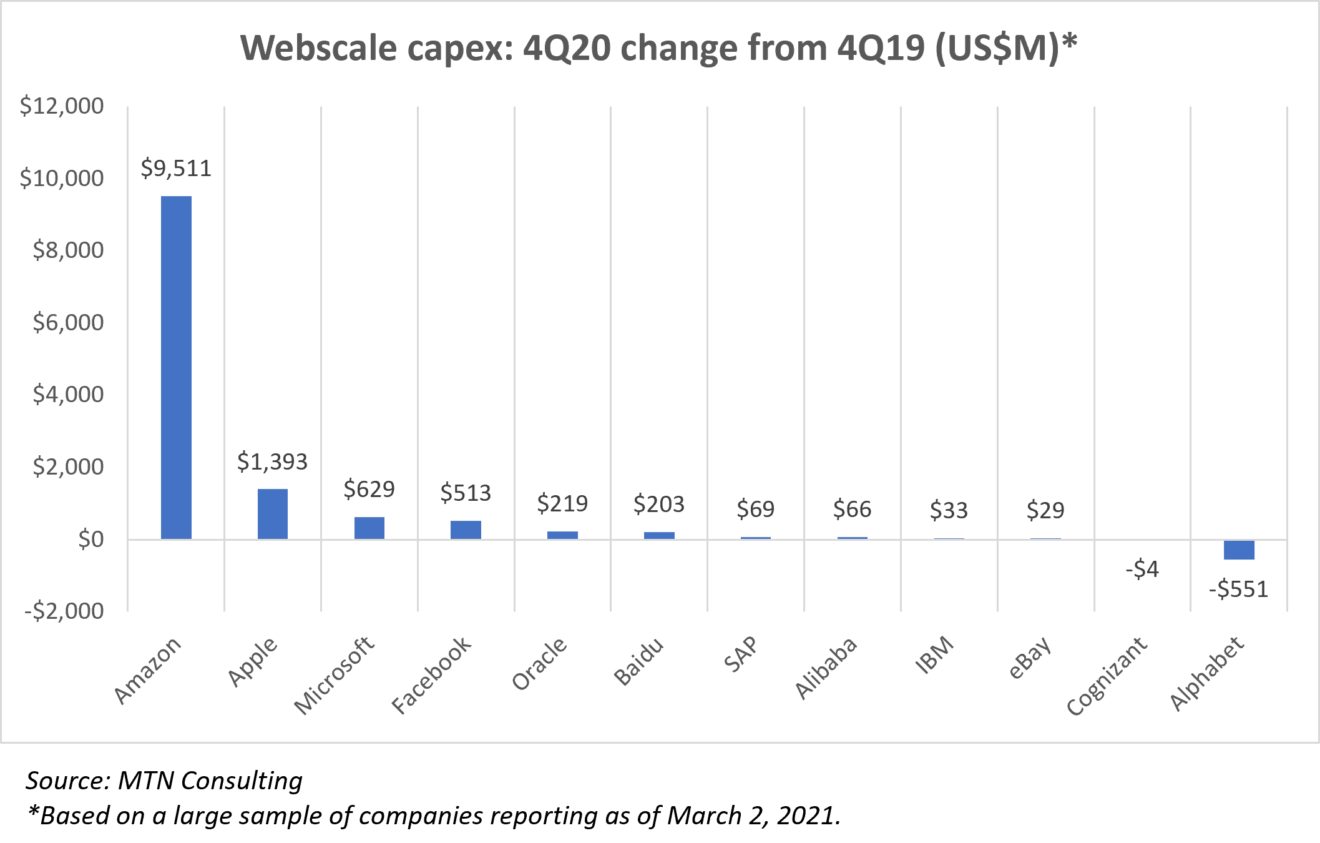

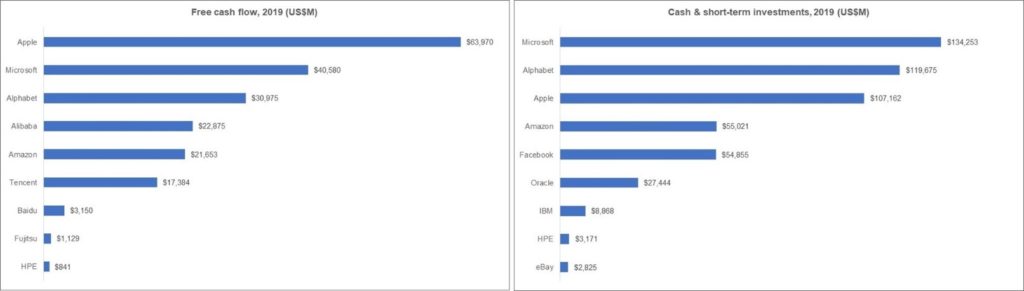

Figure 1 below illustrates just how deep the pockets are in the sector of webscale network operators, tracked by MTN Consulting. The “webscale” sector encompasses big companies in the Internet services industry like Facebook and Google who have built out their own physical network infrastructure to support their services and operations, with data centers taking up much of the spending. The figure shows the free cash flow generated in 2019, and year-end cash reserves, of U.S.-based webscale players.

Figure 1: Free cash flow and cash & short term investments at year-end in the webscale sector, 2019

Source: MTN Consulting, “Webscale Network Operators: 4Q19 Market Review“

These are immense companies which have recorded profit margins far above most other sectors, and for many years. There’s always pressure to grow profits more, or use more of the cash for mergers and acquisitions in order to position for growth of forestall new competitors. But saying that they can’t afford to improve their platforms is a hard argument to make.

Then there’s another question: Why should they bother? Many will read this and, even if they oppose Trump, may think it’s not tech’s job to get involved in politics. It’s not a tech CEO’s job to combat rising authoritarianism, racism, or the metaphorical shredding of the Constitution. That, they will argue, is the job of voters.

However, these tech and telecom CEOs do have a responsibility to ensure their platforms are not used and manipulated by evil actors to do evil things. Not just for moral reasons, but also to ensure their platforms can thrive over the long-term. It’s been clear for at least 3.5 years that many are failing at this aspect of their job.

MTN Consulting’s contribution

MTN Consulting is an industry analysis and research firm, not a company that typically comments on politics. We remain focused on companies who build and operate networks, and the vendors who supply them. That isn’t changing. However, we are going to dig into some of the technology issues related to these networks and networking platforms which are having (or will have) negative societal effects.

Specifically, over the next few weeks, we will issue reports on:

- Bots on social media platforms: How they work, how they shape public opinion, and how they can directly impact elections

- Privacy: How social media and telecom companies exploit user data to sell more ads, and how this user data is often sold to and misused by third parties (including government actors)

- Digital advertising and journalism: How tech companies’ takeover of advertising markets has impacted the news industry and complicated citizens’ efforts to get reliable information

- Deep fakes: How machine learning and artificial intelligence (AI) research, much of it done by the webscale sector, is about to make it even harder to distinguish fact from fiction; how that may reduce the value of social media platforms; and how both webscale players and users will have to cope.

For those of you accustomed to seeing us write about data centers, optical fiber, mobile radio access networks and similarly dry topics, have no fear – that will all continue. This is a moment in time, however, when sitting on the sidelines of more consequential debates is no longer an option.

-end-

Photo by Khalid Naji-Allah, Executive Office of the Mayor via AP