It was the Greek philosopher Heraclitus who coined the phrase, “Change is the only constant in life.”

Well over a thousand years later, Benjamin Franklin continued the thought, saying, “When you are finished changing, you are finished.”

From the wheel to the internet and beyond, the need for change, for new ideas, new technologies, has been a defining element of humanity. Through trial and error, innovators conceive of an idea, conduct research, prove their hypotheses, and develop and refine their concepts. Such research and development have become absolutely vital to the success of the telecommunications industry. Without R&D, humanity might never have evolved past the rotary-dial telephone. There would be no internet, no cell phones, none of the technological marvels we often take for granted … amazing tools that our predecessors likely could not have envisioned even in their dreams.

Or… perhaps they did. After all, the myriad technologies of science fiction are continually becoming science fact. For example, many of the technologies of the original “Star Trek” are commonplace today. The communicators, viewscreens and tricorders of that fictional future exist today as cell phones, laptops, video chats, and advanced sensor packages.

AT&T is another example. Back in 1993, the telecommunications provider (telco) aired commercials that examined what its researchers were developing, and extrapolated the impact of those technologies on the future. The commercials accurately predicted global positioning systems, laptops, tablets, smart watches, keyless entry and on-demand video entertainment … in an era before most homes even had internet connections or home computers.

That was nearly three decades ago. In the time since, you’d expect that AT&T would be spending more on R&D, particularly this far into the digital age.

You’d be wrong.

From 2000 to 2021, AT&T’s annual spending on R&D hovered between 0.7 percent to 1.3 percent of its total revenue. For 16 of those 22 years, AT&T’s R&D expenditures remained less than 1 percent of the company’s total revenue.

Surprised?

Don’t be.

Other telcos show much the same spending pattern. From 2018 to 2020, SK Telecom spent an annual average of a mere 2.2 percent of its revenue for R&D expenses. Telefonica spent less, at 2 percent. NTT spent 1.9 percent; Chunghwa Telecom, 1.8 percent; Orange, 1.6 percent; Comcast and KT Corp., 1.1 percent; and China Telecom, 1.0 percent. Most others, including AT&T (0.7 percent) and LG Uplus (0.4 percent), spent less than one percent of their overall revenue on R&D.

“Telcos (tend to) spend very little on R&D, instead relying mainly on their suppliers for innovation,” Matt Walker, chief analyst at MTN Consulting. “The world has hundreds of telcos but only a few dozen significant suppliers, so some of this is inevitable. The smaller telcos can’t afford to do it all themselves,” said Walker, as they often lack the staffing or the financial resources to conduct their own R&D.

On top of their lack of spending, telcos are also largely slow to innovate. When 4G wireless debuted, telcos rejoiced at the idea of earning new revenues from the networks, which were expensive. However, the majority of the revenue from the new networks went to the companies that build telecommunications devices, like Apple; app companies; content providers, like Netflix; and cloud services companies. This left telcos out in the cold, as they could buy the technology needed to provide 4G, but not truly profit from it.

When 5G networks emerged, the telcos spent big, again hoping for a revenue upside from the investment. Thus far, however, they are in the same position where 4G left them … not benefitting financially, and still wary of spending much on their own innovation and R&D.

“This arrangement worked alright when telcos had limited competition from other sectors,” Walker noted. “However, in the last five years or so, these new ‘big tech’/webscale players have begun encroaching on different aspects of the telco turf.”

Are telcos doomed to repeat the same mistakes? Hopefully not.

Should they be spending more on R&D to help develop new revenue streams? Yes.

Are there examples of leaders in the sector to learn from? Yes.

Telcos should not have to wait on their downstream vendors to innovate and create new technologies, from which they can benefit. Instead, they should take advantage of the growing and rapidly evolving technologies and innovate on their own.

Indeed, some industry leaders are already beginning to call for such a paradigm shift. Aaron Boasman-Patel, vice president of AI & Customer Experience at TM Forum, and Brian Smyth, Accenture’s Global Comms & Media Innovation Lead, conducted research on the matter, the results of which they published in their white paper, “The tech-driven telco.”

“At the most basic level, the world has changed since the telco business model was introduced,” said Smyth. “… At Accenture, we see three mega trends, the first one being the customer – so how we live our life, how we engage with civil society and government, how we work; the second being business model reinvention, … how technology transforms not only customer experiences, but also how customers buy into products and services. We’re seeing within this also a big focus on partnership and partnering together with other organizations to offer new services and experiences.”

“And then finally, it’s the technology revolution. So, in telcos a lot of talk today is around 5G, edge networks, and a lot of this is the confluence of these three points of customer imagination, reinvention, and the technology revolution I think are all leading to this transformation from the traditional telco” to a more tech-driven model.”

Added Boasman-Patel, “If you don’t evolve, then you’re not going to be able to take a slice of the pie – the $700 billion worth of new revenues which are out there today. … If you think about, what we’ve seen through the pandemic, telecoms shares have increased by about 4.8 percent compared to other industries like semiconductors and electronics up by nearly 50 percent, media technology, high 35 percent. … I think when you get above 20% of (revenue spending), whether in industrial manufacturing, or sensor management or whatever it may be, that’s where you can start to say you have become a true techco,” he said.

In November 2021, Ericsson, the world’s second-largest supplier of technology to telcos, surprised many observers by announcing that it was purchasing Vonage, a cloud communications company. That one company would acquire another is standard fare for financial news. Also, it wouldn’t be unprecedented for a telco to buy one of its vendors. The November deal, however, was the reverse: Ericsson, a vendor/supplier to telcos, was buying Vonage, a telco.

“That deal was surprising because it was a traditional vendor buying what seemed to be a telecom provider/telco, i.e. Vonage,” noted Walker.

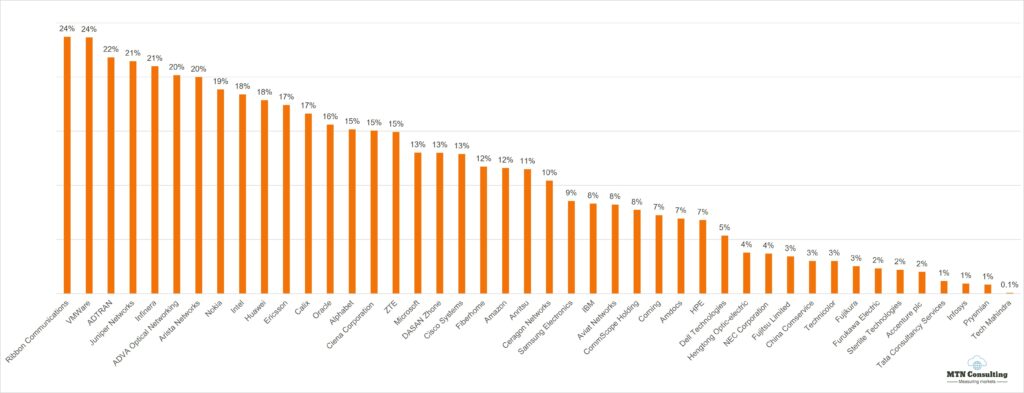

Unlike the typical telco, vendors do usually spend quite a bit on R&D. Ericsson, for example, spent an annual average of 17 percent of its revenue for 2019-2021. Many others spend less, including Alphabet and ZTE (15 percent each); Microsoft (13 percent); Amazon (12 percent); Samsung (9 percent) and IBM (8 percent). In contrast, Ribbon Communications spent 24 percent; Juniper Networks (21 percent); Nokia (19 percent); and Huawei (18 percent). Alphabet and Microsoft are included in these figures because their cloud divisions GCP and Azure, respectively) have become important suppliers to telcos.

Figure 1: R&D spending as % of revenues for select Telco NI vendors, 2019-21 average

Source: MTN Consulting

Ericsson made the $6.2 billion deal in the hopes that, if approved by regulators, its acquisition will help it work with telcos to better monetize apps and services. Ericsson has mapped out a plan to help their telco customers get new sources of revenue from the new networks currently being built. Its acquisition of Vonage means that it now has a telco subsidiary with a dedicated R&D mission. Indeed, unlike the regular low numbers shown at other telcos, Vonage’s R&D numbers tend to trend higher. In 2011, Vonage spent 1.8 percent of its revenue of R&D. In 2014, that number rose to 2.4 percent. In 2019, it hit 5.8 percent, then rose to a high of 6.5 percent in 2020 before dipping to 5.7 percent.

Indeed, Vonage hews closer to the “techco” model favored by Boasman-Patel and Smyth than it does to that of a standard telco model.

“I think mindsets are really important here to drive that change,” said Smyth. “A really interesting example is Microsoft. When Satya Nadella took over Microsoft in 2014, at that point they were hugely profitable as an organization, but not very exciting. And Satya talked about actually wanting to build an organization and products and services that customers would love. And they had missed big trends at this point. They had missed things like search (engines) and mobile, and a lot of people were questioning whether Microsoft’s best days were really behind it at that point, where he came in with this focus on building this growth mindset.

Smyth continued, “The growth mindset is actually … about shifting from the sort of know-it-all to the learn-it -all mindset and being hungry and open to change and collaboration. And what we’ve seen since is a 10x growth in the market cap of Microsoft. And an incredible performance and a complete refresh of the brand, attracting young talent, attracting the next generation of sort of leaders across new technology domains and re-cementing their position in future technologies, whether it’s cloud, or now looking at the metaverse.”

Vonage, like Microsoft, leaned into its own evolution.

“Vonage was no longer just a telco” by the time Ericsson announced the acquisition deal in 2021, said Walker. “It started life as this, but had evolved more into a hybrid in the last five years, creating lots of its own intellectual properties (IP). From 2018 to 2021, Vonage spent about 6 percent of revenues on R&D, way higher than the average telco, and closer to a vendor.”

Indeed, Vonage’s most recent annual report tells the story of its evolution from telco to techco: ““Founded in 2001, Vonage was among the first companies to provide Voice over Internet Protocol technology offering feature-rich, low-cost home phone services. Through a series of strategic acquisitions and organic growth, Vonage since has transformed from a VoIP-based residential service provider to a global leader in business cloud communications.”

Vonage also has a long list of patents, which helps fuel its innovations.

“Vonage does some things that don’t look like what a vendor (Ericsson) would normally do,” noted Walker. “But Vonage’s R&D creations (will) allow Ericsson, in theory, to provide valuable support to its other telco customers in an important area, i.e. monetizing the network through use of APIs,” or Application Programming Interfaces, which permit different applications to communicate.

Although most U.S. telcos continue to play it safe, telcos in the United Kingdom have begun to increase their R&D sending. In 2020, they spent over 1 billion pounds (1.2 billion pounds, or $1.56 billion USD) on R&D … the first time they have done so in nearly 10 years.

According to the British Office for National Statistics, the telco sector boosted its R&D spending by 4.5 percent during 2020, to 1.03 billion pounds. They last spent that type of money on R&D in 2011, when they spent 1.04 billion pounds.

However, not surprisingly for a time during a pandemic, UK R&D spending by telcos and all other industries remained in the shadow of pharmaceutical sector, which boosted its R&D spending by 6 percent to 5.02 billion pounds ($6.19 billion USD).

“There’s a demand from industry to actually partner and collaborate with (communications service providers) to build out these new services,” said Smyth. “… It’s quite interesting from some of the initial feedback we’re hearing there is a desire on the CSP side to really just offer connectivity solutions, sell connectivity. So, I think what industry is looking for is support in solving their business problems. And I think there’s great opportunity for CSPs as they’re building the scalable platforms to actually go in and partner and co-create with industry to build solutions.”

4G set sail some years ago, and telcos largely missed the boat. It’s still relatively early in the rise and growth of 5G. Hopefully, telcos will learn from the mistakes they made with 4G. If they prioritize creating and funding new R&D initiatives, they can evolve into more technology-driven companies. This will allow them to benefit, in terms of technology and revenues, from 5G.

It’s not too late for telcos to fully get on board with 5G … before that opportunity also sails out of reach.

About the author

Melvin Bankhead III is the founder of MB Ink Media Relations, a boutique public relations firm based in Buffalo, New York. An experienced journalist, he is the president of the Buffalo Association of Black Journalists, and a former editor at The Buffalo News.

*

Cover image: iStock